CAT Management: Solutions Via Insurance Claims Software

On the average day for an insurance carrier, independent adjuster firm, or third-party administrator, routing and assigning claims in a timely manner can be a struggle. From streamlining First Notice of Loss (FNOL) to managing disparate data across various systems, there are many points along the way where staff members can get overwhelmed and customers can become dissatisfied.

Add to that a large catastrophic (CAT) event like a hurricane or several mini-CAT events like hail, floods, wind, and tornadoes, and the situation becomes untenable as claims surge. No wonder claims operations teams are stressed during CAT season every year.

In 2021, insured losses from natural disasters again exceeded the previous 10-year average. This is in line with the annual trend of 5-6% rise in losses seen in recent decades, according to Swiss Re. The two costliest natural disasters of the year were both recorded in the US, including Hurricane Ida which caused $30-32 billion in estimated insured damages.

In This Article

When you combine the increase in CAT events with continued economic development, you have the perfect recipe for more frequent and severe claim events. That’s why insurance carriers need to adapt their processes. Automated claims processing and data management are the only way to avoid employee burnout and provide strong customer service during CAT events.

Challenges of Effective CAT Management

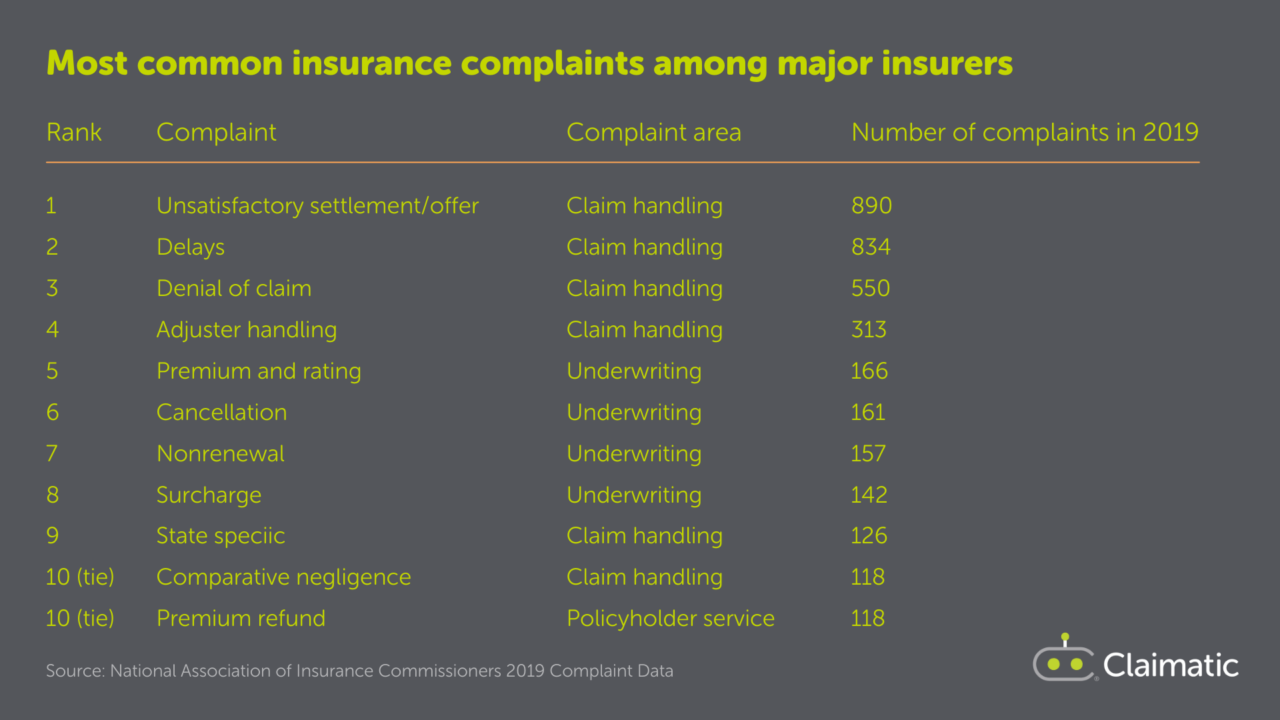

People who are insured pay years of premiums to their insurance carriers and expect for them to come through in times of need. But that’s the exact moment when carriers are the most overwhelmed with claims surge and data they have to manually incorporate to service them. So, CAT events naturally lead to lower net promoter scores and higher customer churn. Here are the major pain points to solve for effective CAT management.

The Unknown: How Bad for How Many?

When natural disasters strike, projected loss is extremely difficult to calculate. How bad is the situation going to be? How many people will need our services? What resources are available and how soon can we deploy them? Those things are different every single time and no amount of proactive CAT management can take care of all a carrier’s needs.

Team Capacity & Burnout

It’s no secret that burnout is prevalent in the insurance industry, especially during CAT events. It requires being on call and working long hours under stressful and dangerous conditions.

In a time when teams must be at the top of their game to triage requests and respond quickly, carriers find themselves compensating for thin resources, employee attrition, and low productivity as a result of stress.

Managing External Resources

Here’s the all too common nightmare scenario: an insurance carrier is managing data outside of systems in Excel for a CAT event – yikes! Yes, natural disasters require additional data to help sift through claims. But that all needs to be present and actionable in the system where employees work every day.

And while extra hands on deck are usually essential, carriers struggle to know exactly what tier of resource is needed and how to help external adjusters understand local regulations. These range from full-time employees to 1099 contractors to independent adjusters, which vary in cost and are best suited for different scenarios.

Time Crunch for Relief

Decisions need to be made fast since CAT events cause terrible disruption and pain in the lives of those affected. Many carriers are not able to react in real time as situations further develop, whether it’s because disconnected data is filtering in or team communication goes out the window. This leads to an inefficient use of resources: you might send an adjuster when it’s not needed in a certain area or miss an opportunity to reroute certain types of claims.

Additionally, every state has different regulations around communication after FNOL and claims re-assignment. These all need to be followed to provide good customer service and avoid penalties.

The Solution: Insurance Automation for CAT Events

Claimatic is the insurance industry’s first SaaS solution dedicated to automating claim triage and assignment for optimal routing. By enabling your operations team to incorporate an unlimited array of decision criteria, the most ideal resources are assigned to each claim (even during CAT events!). This augments the capabilities of existing core claims management platforms using the data you already have.

If you’re like many carriers currently pursuing a move to cloud, Claimatic can improve your operations around your legacy system today and also transition with you in your digital journey.

Here’s how Claimatic solves the challenges of CAT management.

Scenario Planning

Claimatic has the ability to pre-stage assignment rules to handle any scenario, deploy the rules at will, and easily revert back to normal operations once the surge has passed. You have the power to create and test scenarios outside of production, move back and forth between rules with ease as demand fluctuates, and update vendor assignment weighting and preferences based on real-world outcomes.

Data Management

Claimatic makes it possible to maintain a top-down, categorical data structure to make quick changes in mass without disrupting business. This means that during a CAT event, you can leverage existing data or pull in new data sources to inform your strategy. It’s all within the Claimatic system, which provides your team with efficiencies that will make a big difference.

Workforce Management

With Claimatic, you can easily configure and monitor resource availability as well as team capacity. Manage assignments to internal and external parties or both without any friction, and integrate with external resource management systems via API. During CAT events, this enables you to scale your team appropriately.

Custom Dashboards & Reports

Here’s where you can up-level your real-time management of CAT events. Monitor claim assignments, resource availability, capacity, licenses, skills, and more via built-in or custom dashboards and reports. You can even view these in the field – they are friendly with any device or browser and offer configurable custom views.

Automated Claims Assignment

Even during claims surges, Claimatic allows you to assign claims in seconds after evaluating more than 25 standard and unlimited custom attributes. It can also trigger resource assignments from most leading claims management applications, as well as “homegrown” systems.

Plain English Rules

You won’t need a developer to create and modify rules – no code required! Build rules using if/then logic and then drag-and-drop them into place.

The Future of CAT Management

It’s time for the insurance industry to invest in strategies that improve CAT management for both customers and the employees who serve them. Insured losses from natural disasters in 2020 reached $97 billion and were well above the 21st-Century mean and median values. That annual number is only going to climb higher.

By using Claimatic to automate claims assignment, integrate valuable data sources, and manage team workflow, carriers will save money during CAT events while providing better customer service with happier employees. This is the future of CAT management – and it’s a brighter one where tragic events don’t come with any more stress than they already bring to the table.