You’re Moving to the Cloud: Are your Integrations Moving, Too?

Every insurance business in the digital world is preparing for the coming change from on prem and private servers to the cloud. This challenge is one of the biggest insurance industry trends in 2022 – and likely for years to come, as most companies expect the transition to last several years.

With so much time, energy, and budget invested in the migration to cloud, it can be easy to delay needed business updates like automating claims management for fear of further complicating an already complex transition.

But with Claimatic, our APIs are built around your business processes, but designed to be portable and protect your operational stability—so you can streamline and improve your claims management process today without worrying about interrupting or delaying your cloud transition tomorrow.

In This Article

The Push to the Cloud

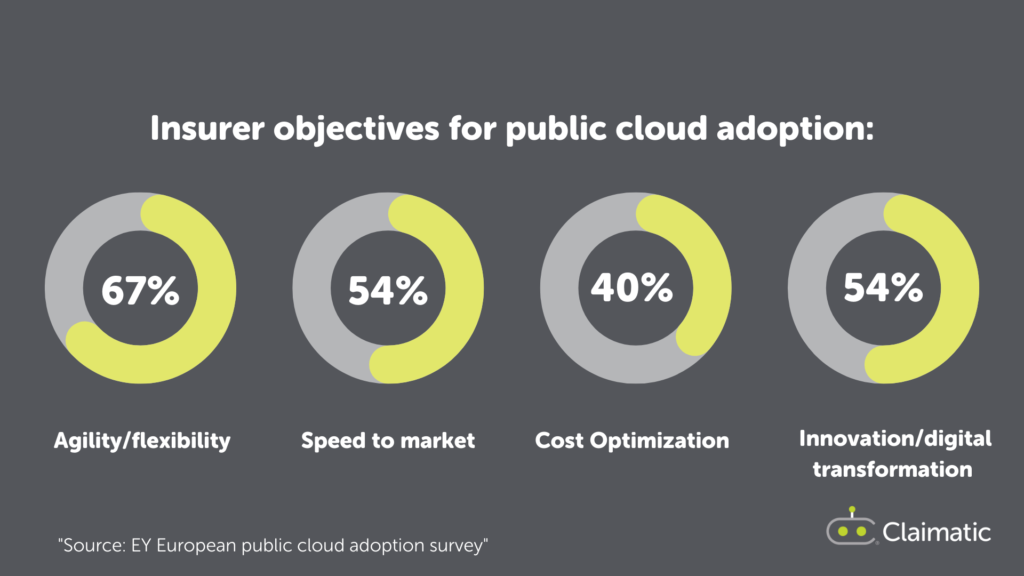

As of 2020, 89% of CIOs surveyed for Microsoft Inspire 2020 said they were investing in cloud technologies to modernize their technology stack. Among insurers, most plan to move at least 80% of their business to the cloud in coming years, with 67% citing improved agility and flexibility as their primary objective in an EY survey.

Moving to the cloud isn’t happening in a vacuum, and it’s important to stay on top of industry trends even as you prepare for the cloud migration. Most insurers know that automation and use of cloud-native technologies are crucial to future success – and are a big part of the drive to move to the cloud.

In fact, EY found that in interviews, leading organizations are already investing heavily in these key areas and are spending more than 3x what they had been on tech. The ability to gain insights and predictive abilities are one area of high interest, and another is intelligent automation that lifts the stress of every-day tasks from workers and allows them to focus more on higher-value work.

Tools like Claimatic that automate and improve claims management are a big piece of the puzzle for the future of the insurance industry—both before the move to the cloud and after.

Preparing for Migration

The digital transformation of the industry and the transition to cloud is drawing much of the focus of the insurance industry – and much of the anxiety. IT leaders who have been through migrations cite hundreds of thousands of dollars in cost in the average migration – and that such transitions rarely come in under budget.

One of the areas causing the most consternation and stress is how to ensure the existing workload, technologies, and applications move with the business into the cloud. Last year, 65% of companies surveyed by Next Pathways said cloud migration was a top three area of focus—but 33% were worried about disrupting critical business applications during the migration and 22% were unsure how to even start due to application sprawl!

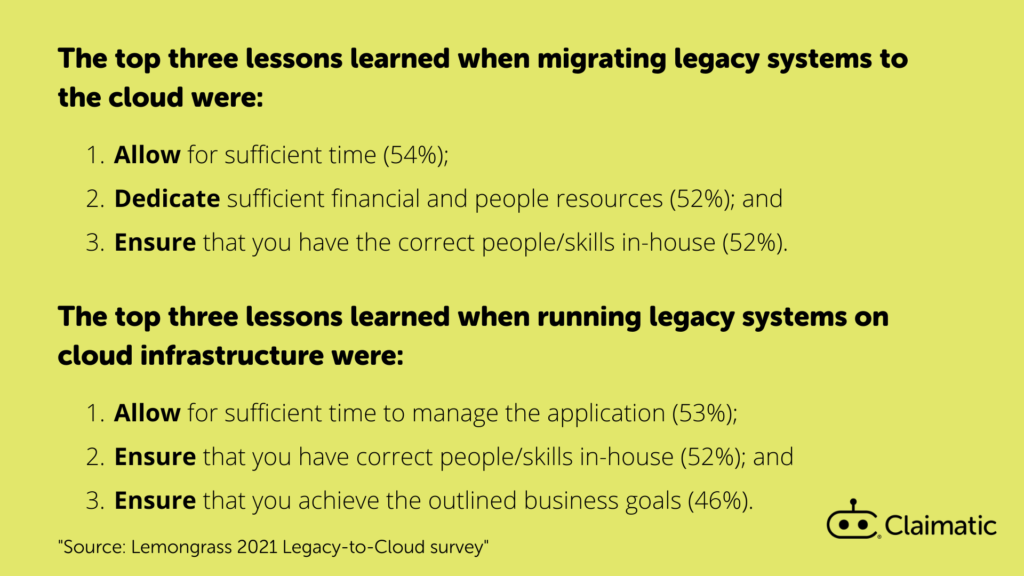

For companies who had been through a cloud migration, 42% said their top challenge once legacy systems had been moved over was training end users to use them now that they were running on cloud infrastructure. More than half identified the importance of allocating enough time, finances and people resources – and ensuring you have the correct people in house.

Stabilize with Cloud-Ready Technology

Especially in an insurance industry that is already facing a labor squeeze and concerns about where the next generation of workers will come from, the concerns and needs of the cloud migration can be paralyzing for the business. In fact, they are a reason to move forward with efforts to streamline applications and ensure your business is already working with technology that is cloud-ready.

When implementing any new technology, companies need to ensure that they contribute to long term operational stability, and won’t compromise it further down the road of digital transformation. Any new processes you build around new tools must move smoothly into the cloud.

With Claimatic, you can rest assured that our claims management tools will make your business operations stronger today and tomorrow. Your new and improved triage and assignments processes with Claimatic will stay completely stable through the move to the public cloud—with no change to the user experience or interface, and no need to retrain on the same tool. You can get Claimatic up now, confident that it will be one less thing to worry about during your cloud migration.

Keep Moving Forward With Claimatic

The insurance industry can’t afford to delay its embrace of smart technology and automation as new economic complexities, shifting labor markets, and customers demanding ever more speed and flexibility present new challenges.

That’s why Claimatic is focused on helping insurers streamline their claims management processes to create faster, more efficient, less error-prone operations that benefit both customers and employees. Best of all, Claimatic is cloud-ready and will port over with your business operations as you move to the cloud—seamlessly and stress-free.