What’s Beneath the Surface of Industry Disruptors?

Every legacy industry is faced with challenges from disruptors looking to be the next big thing in Silicon Valley. The insurance industry is no exception. Technological advances and innovations have brought lots of new players to the space, aiming to solve real user concerns while presenting slick interfaces and flashy marketing.

But when you look closer, are any of these new players doing anything to revolutionize our business? Although VC investment in insurtechs nearly doubled in 2021, the end of the year saw declines in insurtech share values as investors focused more on profitability. In the recent CBInsights State of Fintech report, Q2 of 2022 saw the lowest fintech funding across the board since 2020.

The question looms: do disruptors have the industry acumen to scale into sustainable insurance businesses?

Legacy companies can take advantage of this moment of flux by taking a page from the insurtechs’ book and improving on it, by responding nimbly to the realities of change in the industry. Integrating with the best of new technologies like Claimatic can allow you to tackle the same customer-driven concerns insurtechs solve for, while maintaining understanding of the heart of the business.

In This Article

The Millennial and Gen Z Revolution

Much of the focus of insurtechs has been up front, to make a splash that brings in customers and solves specific issues facing new generations reaching the life stages where they need insurance.

The industry has known for years that upcoming generations see less value in insurance. Influenced by the customer experience revolution driven by Big Tech companies like Apple and Google, they want insurance to be more tailor-built for them. For example, in the auto insurance field, millennials and younger are less likely to drive and more likely to buy insurance through an app, creating a customer-driven need for low-cost auto insurance with rates tied to mileage.

But as insurtech companies leap to solve those very specific problems, what’s missing is investment into the core pillars that insurance business is built upon: the underwriting of insurance, claims servicing, regulatory overhead, and distribution. Without this, insurtech models are unproven at scale, risking total collapse as their businesses grow and face the challenges of scale.

Insurtech at Scale

As a recent Weatherford Capital report puts it, even in the face of customer demands and technological improvements: “Many core processes needed to survive—quoting, underwriting, claims servicing—are frequently tied to manual, human-intensive workflows.” And while insurtechs look splashy and draw customer attention, they still are estimated to control less than 1% of the insurance market that is dominated by big players.

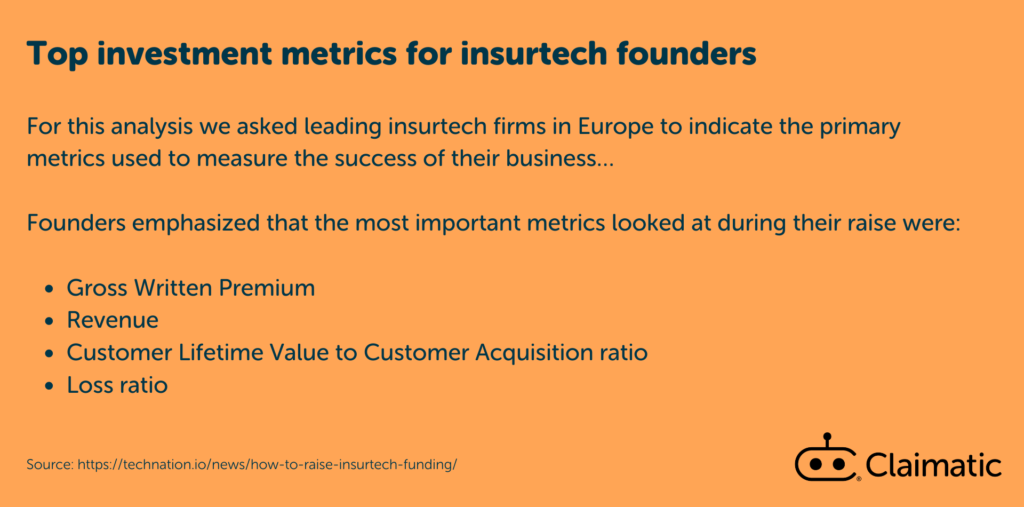

Meanwhile, investor mindsets are evolving to require that forethought to prove out models at scale. A 2022 TechNation piece on how insurtechs can best draw new investment is heavily focused on showing the need for understanding and mastery of core insurance processes–even as it notes that the complex and fragmented industry is ripe for disruption.

In a survey of European insurtech founders, TechNation found key metrics that investors focused on included indicators of a strong revenue model. Among the tactics pinpointed for driving revenue through Gross Written Premiums were either becoming full-stack insurers (with the necessary regulatory and cash requirements) themselves, or operating as a Managing General Agent (MGA) on behalf of legacy insurance companies.

Weatherford Capital reports “an emphasis on maximizing for loss ratio, policy retention, and acquisition costs has been rewarded in 2022.”

Claims Management and Risk

As insurtechs look to stabilize at scale, underwriting risk can be mitigated by any number of readily available data sources. Claims handling cannot.

Claims operations are the industry’s trenches where boots hit the ground and expertise in managing wide-ranging scenarios is imperative. Scalable desk and field operations can’t be built on the fly, which is why traditional incumbents shine in this area – some have over 100 years of experience. Missteps in claims handling don’t just affect the bottom line in terms of cycle time and LAE, but a poor claims experience is among the top causes of policyholder churn. Having amazing distribution capabilities won’t save the day when policyholders routinely jump ship.

Stay Ahead with Claimatic

As insurtechs are called to adapt by better integrating the legacy knowledge at the heart of the insurance industry, the legacy industry can in turn adapt by folding in insurtech tactics: responding to the needs and demands of the market by making the best use of technology.

Claimatic’s claims management software is proven to integrate with tools already used by 80% of the industry and improve operations. Our automated systems allow claims triage and assignment to happen in seconds, requiring less hands-on management from your claims team, benefitting both customers and employees with faster outcomes with fewer errors.

Best of all, Claimatic can be set up in weeks, not months and is cloud-ready.