How to Address Employee Turnover in the

Insurance Industry

As insurance employees increasingly face burnout and the need to reskill for digital transformation, carriers must improve retention and training efforts to avoid high voluntary turnover rates. Plus, many employees are aging out, creating gaps that are hard to fill in a candidate-driven market.

Overall turnover rate in the finance and insurance industry was 25% in 2020, according to Zippia. And 43% of insurance talent employees surveyed by Deloitte say it’s getting harder to find skilled candidates in a number of functional areas including claims.

In This Article

With high staff attrition rates affecting the bottom line and employee satisfaction, carriers need creative tech solutions to benefit from the industry’s projected growth and not fall behind.

The Challenges to Employee Retention in Insurance

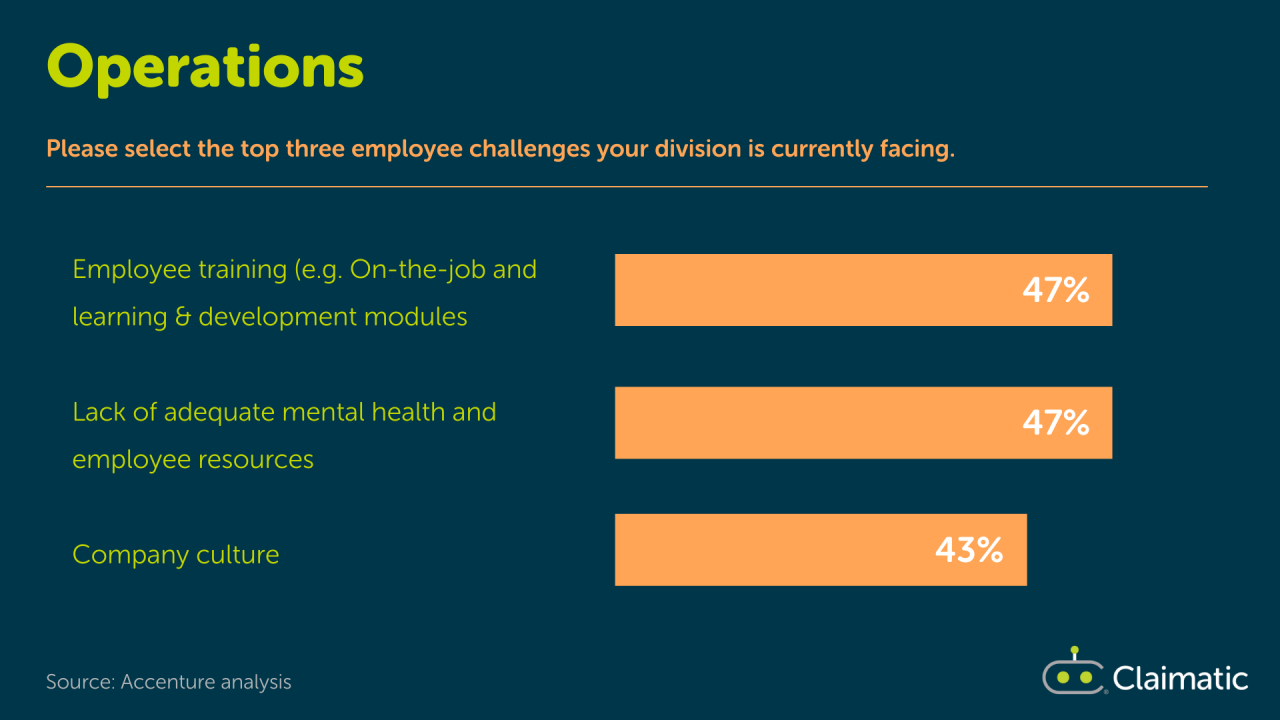

In a recent Accenture survey to HR, sales, technology, operations teams in insurance, all four groups noted employee training as a top one or two challenge in the industry. Here are some of the related challenges we’ve seen while working with carriers to streamline claims.

Keeping Pace With Digital Transformation

As carriers invest in technology for more sophisticated claims triage, adjusters and other team members need to adapt and cultivate skills that complement the tools. A BCG report shows that 71% of employees in insurance said they are willing to reskill, but that requires leadership and support.

Filling Roles as Employees Age Out

When adjusters, FNOL staff, and leaders reach retirement age, carriers without strong succession plans and talent development programs lose valuable institutional knowledge that can’t be replaced. It can be a large portion of employees – for example, 65% of workers in the property-casualty industry were over the age of 40 as of 2018 and 11.5% were over the age of 60.

Protecting Employees From Burnout

With long hours and frequent stressful events, insurance employees are already at a high risk for burnout. When you add to that the difficulty of hiring top talent and up-skilling current employees, teams are likely to be understaffed. And this increases employee churn, in a never-ending cycle unless carriers staff up and provide support.

Engaging Employees in Your Mission

Building and maintaining a strong company culture is important for carriers looking to retain employees. This includes helping each person connect with the company mission and see how their job supports it. Creating opportunities for job advancement and a positive environment for interpersonal relationships is also key. In 2021, the perceived value of solid relationships with peers was reported as insurance employees’ top priority.

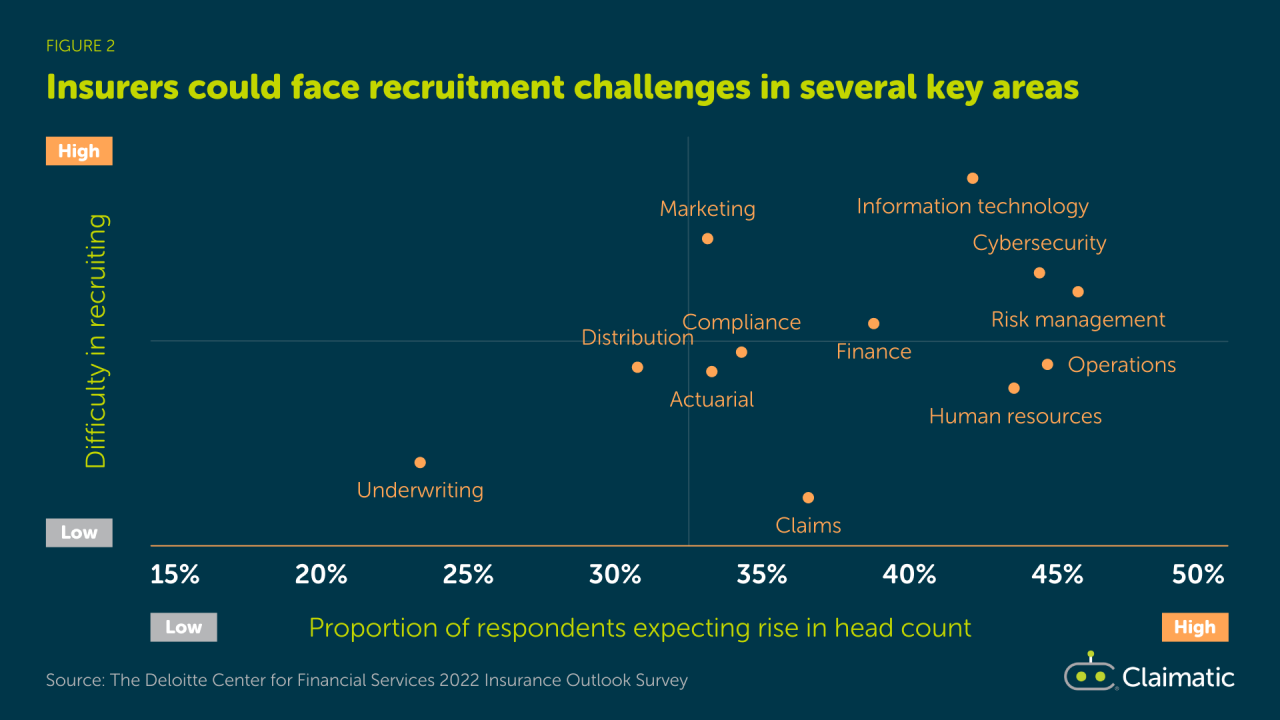

The above chart from Deloitte’s 2022 Insurance Outlook Survey demonstrates areas with high need and high difficulty recruiting. While areas like compliance, operations, and risk management rank high on the list, the good news is that many tasks associated with these roles can actually be covered by sophisticated claims automation software.

The Solution: Claims Automation

That Improves Job Satisfaction

Claims automation may not be the first thing that comes to mind when you’re looking for hiring and retention solutions, but it should be. The more sophisticated your claims process, the less clerical work (and thus less training) is needed. Employees just collect the information and let the tool do the rest instead of needing to know how to manage every possible claims permutation.

This reduces overall risk because you can avoid having unqualified people touching claims. And when employees retire or leave the company, you have their knowledge documented in a system instead of losing it.

Automation gives employees room to upskill in areas of interest that will benefit your company and support their career advancement — a win/win for all parties. It also creates more opportunities for employees to work cross-functionally and build strong relationships across the company.

Claimatic is the insurance industry’s first SaaS solution dedicated to automating claim triage and assignment for optimal routing. It builds on the tools and data you already have to make fast decisions, reduce reassignments, and accelerate claims processing.

Our platform is SOC 2 Type II Certified and is a low-code/no-code solution so that your IT or development department doesn’t have to be hands on.

Automated Claims Assignment

Automatically assign claims in seconds and trigger resource allocation from leading claims management applications as well as “homegrown” systems. Claimatic intelligently evaluates more than 25 standard and unlimited custom attributes to ensure this automation is on target. It reduces the room for error by automating tasks that would normally require extensive training.

Workforce Management

With Claimatic, you can easily configure and monitor resource availability as well as team capacity. Manage assignments to internal and external parties or both without any friction, and integrate with external resource management systems via API. This helps you flag situations where your team is getting stretched thin and take action to protect them against burnout.

Data Management

Our top-down, categorical data structure enables you to integrate all your data and pull in new sources of information as you get them. This makes employees happy as they can work within one system and avoid errors created by manual data manipulation. Claimatic’s data management tools enhance your ability to route claims efficiently and identify every possible straight-through processing opportunity.

Custom Dashboards & Reports

From workload to claim status, your team can stay up-to-speed using built-in or custom dashboards and reports. These can be viewed at a desk or in the field because they are friendly with any device and browser. By taking the hassle out of regular reporting, employees will feel more invested and connected to your organization.

The Insurance Workforce of the Future

Will adopting a new automation tool affect the skills your employees need to have? Yes, but that aligns with industry trends and is a shift you need to make sooner rather than later.

According to research from McKinsey, the need for technological skills will increase 55% from now through until 2030, while the need for physical and manual skills will fall by 14%. In claims specifically, the expectation is that 50% of the tasks associated with that role will become automated.

By adapting and working toward automation now, you can keep pace with competitors and create a fulfilling place for employees to work for the long haul. Proactively future-proofing also sets you up well to scale quickly, which will give you better outcomes than waiting until rapid growth is upon your company.