Sophisticated Claims Triage: Boost Your Auto Insurance Software

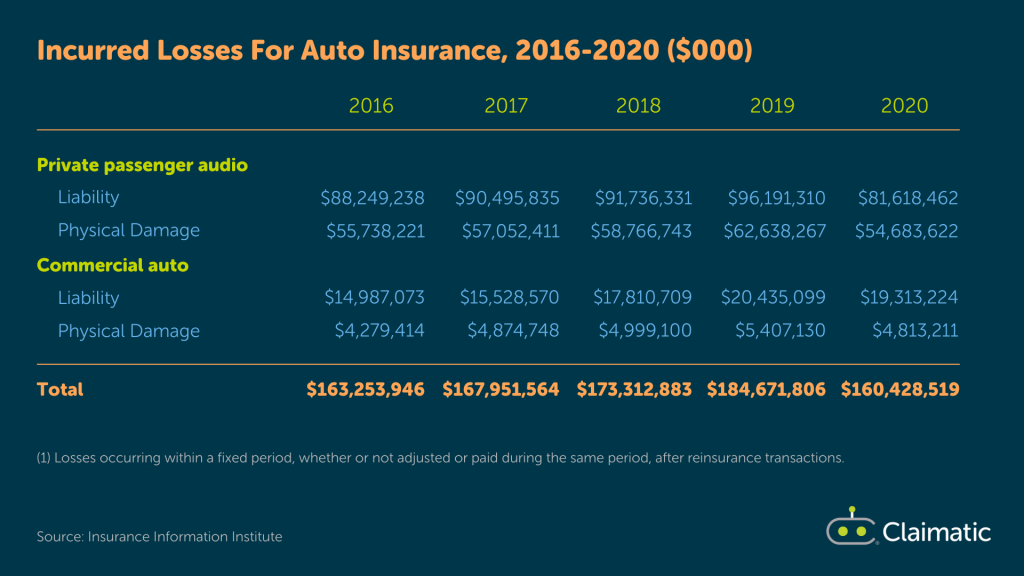

Incurred losses for auto insurance were nearly 15% less in 2020 than in 2021, according to the Insurance Information Institute. This sounds like good news, but it’s a trend that’s not likely to hold steady since reduced driving during the COVID-19 pandemic had a big impact.

Deloitte’s 2022 Insurance Outlook reports that insurers generally expect more rapid growth this year as demand rises and economic recovery continues. With rapid growth comes the typical challenges of avoiding fraud, resolving claims quickly, providing strong customer service, and more. The complexity of advanced driver assistance systems and other tech innovations on the horizon add to those challenges.

Investing in auto claims management software is a key way for insurers to address challenges, streamline the claims cycle, and identify more straight-through processing opportunities.

In This Article

Straight-through processing is one of the two main reasons that customer satisfaction is at a record high, according to J.D. Power’s 2021 Auto Claims Satisfaction Study. The other reason is that customers are seeing higher replacement values due to the national vehicle price surge.

As prices normalize, commutes return, and claim severity increases, the report suggests that “insurers with more sophisticated claimant triage will be better positioned to navigate the growing cost and complexity ahead.”

The Challenges to Streamlining Auto Insurance Claims

The average American pays $1,674 a year or about $140 a month for auto insurance. Whether filing a claim that includes property damage, personal injury protection/med pay, and/or bodily injury, insurance customers look for minimal inconvenience and maximum payout.

An important decision point for auto carriers is whether to optimize claims for customer service or cost. With a customer service focus, one adjuster needs to handle the entire claim even if it has multiple types of exposure. With a cost-efficiency focus, a specialist for each exposure type should handle that part of the claim.

Claimatic enables you to optimize for either of these elements while also solving the common pain points below.

Unnecessary Costs

Any delay in assigning or processing a claim leads to increased costs for car rental and storage as well as a greater chance of customer dissatisfaction. In fact, the most likely time for a customer to leave their insurer is following a claim. Moving claims along as quickly as possible and taking advantage of straight-through processing opportunities are critical to your bottom line.

Load-Balancing for Vendors

From rental car companies to repair shops, auto insurers need multiple partners available to move claims along. Having a range of preferred vendors on hand is essential since some reject work that doesn’t meet certain criteria, e.g., quick-turn jobs preferred by repair shops.

Disconnected Data

Is your team putting all your available data to work? Probably not, since many auto carriers manage certain data outside their systems or use it inconsistently. Integrating data can help you improve claim efficiency and avoid variable customer outcomes.

Subrogation Nuances

Twelve states in the U.S. are no-fault and the others require subrogation. If your auto insurance claim software doesn’t have the ability to route these accordingly, claims take more time to process and incur greater cost.

The Solution: Auto Insurance Claim Automation

Many claims management platforms lack the sophistication needed to incorporate an array of decision criteria and identify the ideal resources for each claim. That’s where Claimatic comes in.

Claimatic is the insurance industry’s first SaaS solution dedicated to automating claim triage and assignment for optimal routing. It builds on the tools and data you already have to make fast decisions, reduce reassignments, and accelerate claims processing.

Our platform is a low-code/no-code solution so that your IT or development department doesn’t have to be hands on. We help set you up, and then your claims team can drag-and-drop rules using if/then logic.

Here are just some of the ways that Claimatic solves the challenges of auto insurance claims.

Automated Claims Assignment

Automatically assign claims in seconds and trigger resource allocation from leading claims management applications as well as “homegrown” systems. Claimatic intelligently evaluates more than 25 standard and unlimited custom attributes to ensure this automation is on target.

Workforce Management

With Claimatic, you can easily configure and monitor resource availability as well as team capacity. Manage assignments to internal and external parties or both without any friction, and integrate with external resource management systems via API. This enables your team to scale your team appropriately.

Data Management

Our top-down, categorical data structure enables you to integrate all your data and pull in new sources of information as you get them. This enhances your ability to route claims efficiently and identify every possible straight-through processing opportunity.

Custom Dashboards & Reports

From capacity to claim status to fraud occurrences, your team can stay up-to-speed using built-in or custom dashboards and reports. These can be viewed at a desk or in the field because they are friendly with any device and browser.

Emerging Technologies and Changes to Auto Insurance

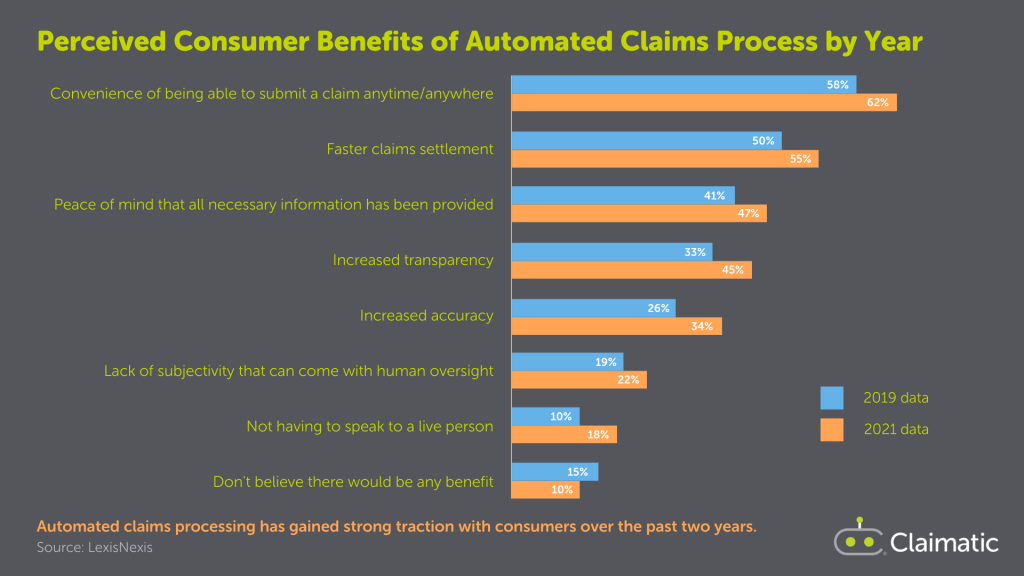

The auto insurance industry is ripe for transformation as telematics, a growing gig economy, autonomous vehicles, and other factors bring both challenges and opportunities to the mix. The LexisNexis Future of Claims report predicts that by 2025, more than 80% of auto insurance claims will be processed virtually. And up to 50% of non-injury claims will be fully automated.

That’s why Claimatic is focused on helping auto insurers do everything they can to standardize data and effectively automate processes. With so much impending change, auto insurers need to invest in intelligent-decisioning that improves customer experience and reduces claims processing costs.